How to Find Free or Low-Cost Burial Insurance

Funeral insurance, sometimes called final expense insurance, is a type of life insurance that helps cover funeral and burial costs. It's a straightforward way to reduce the financial burden on loved ones when the time comes. Finding affordable funeral insurance isn't as complicated as it might seem. This guide will walk you through options available in Australia for free or low-cost funeral insurance.

Who Should Consider Funeral Insurance?

Funeral insurance can provide peace of mind for those who want to avoid placing a financial strain on their families. Here's who might benefit most from this type of coverage:

1. Seniors

Seniors over 50 often look to funeral insurance as an affordable way to ensure funeral costs are covered. These policies offer predictable, fixed premiums that are manageable for those on a limited income.

2. People with Limited or No Savings

With funerals typically costing $4,000 to $15,000, funeral insurance can be a good option for those without enough savings to cover these expenses, helping protect loved ones from unexpected costs.

3. Individuals Without Sufficient Life Insurance

If you don't have life insurance, or if your policy doesn't fully cover funeral expenses, funeral insurance provides specific coverage to meet end-of-life costs.

4. People with Health Conditions

Most funeral insurance policies don't require medical exams, so they're accessible even for those with pre-existing health conditions.

5. People Looking for Low-Premium Options

Funeral insurance is often more affordable than traditional life insurance, offering smaller, specific coverage amounts that fit within a tighter budget.

6. Those Seeking Peace of Mind

Funeral insurance gives people peace of mind, knowing that their families won't face a financial burden during an already challenging time.

Free or Low-Cost Funeral Insurance Options

There are several options available to help you cover burial costs without breaking the bank. Below, we outline the costs, benefits, and limitations of various funeral insurance alternatives:

1. Funeral insurance Policies (Final Expense Insurance)

Average Monthly Premium: $25–$100

Coverage Amount: $3,000–$15,000

Who it's best for: Seniors or those with limited savings.

Benefits: These policies are easy to apply for and often have minimal medical requirements, making them accessible for most.

Limitations: Premiums increase with age, and coverage amounts may be lower than traditional life insurance policies.

2. Superannuation Death Benefits

Many Australians have superannuation accounts that offer a death benefit payout, which can help cover funeral expenses.

Cost: Usually included in superannuation accounts.

Best for: Most working Australians.

Limitations: Coverage may vary depending on the account balance and insurance terms within the super fund.

3. Centrelink and State Government Assistance

Cost: Free or need-based assistance.

Eligibility: Low-income individuals or those receiving government benefits.

Benefits: Centrelink provides limited assistance, such as Bereavement Payments, to help eligible people cover funeral costs.

Limitations: The assistance amount is generally modest, and eligibility requirements must be met.

4. Veterans' Burial Benefits

Cost: Free or low-cost.

Eligibility: Australian Defence Force veterans or their families.

Benefits: May include financial support for funeral costs or burial in a veterans' cemetery.

Limitations: Specific eligibility criteria apply, and the benefit amount may not fully cover all expenses.

5. Funeral Bonds

Cost: Flexible, based on how much you contribute.

Coverage Amount: Varies, as it's a savings vehicle specifically for funerals.

Best for: Individuals who prefer saving specifically for funeral costs.

Benefits: Helps you save for funeral costs and earns interest, potentially reducing the need for insurance premiums.

Limitations: The funds are designated solely for funeral expenses.

6. Crowdfunding (e.g., GoFundMe)

Cost: Free to start a campaign (though a small transaction fee applies to donations).

Benefits: Family, friends, and community members can contribute to help cover funeral costs.

Limitations: Success varies, and you may not raise the full amount needed.

7. Credit Union or Bank Life Insurance

Cost: Low-cost policies, often offered as a benefit to account holders.

Coverage Amount: Usually around $1,000–$2,000.

Benefits: A small, easy-to-access policy that can help with funeral costs.

Limitations: Coverage amounts are limited, so this may only cover part of the total expenses.

8. Fraternal Organizations or Unions

Cost: Generally low-cost, depending on membership dues.

Coverage Amount: Typically between $1,000 and $10,000.

Benefits: Many unions or fraternal organizations offer small burial or life insurance benefits to members.

Limitations: Coverage may be limited and may only offset part of the funeral cost.

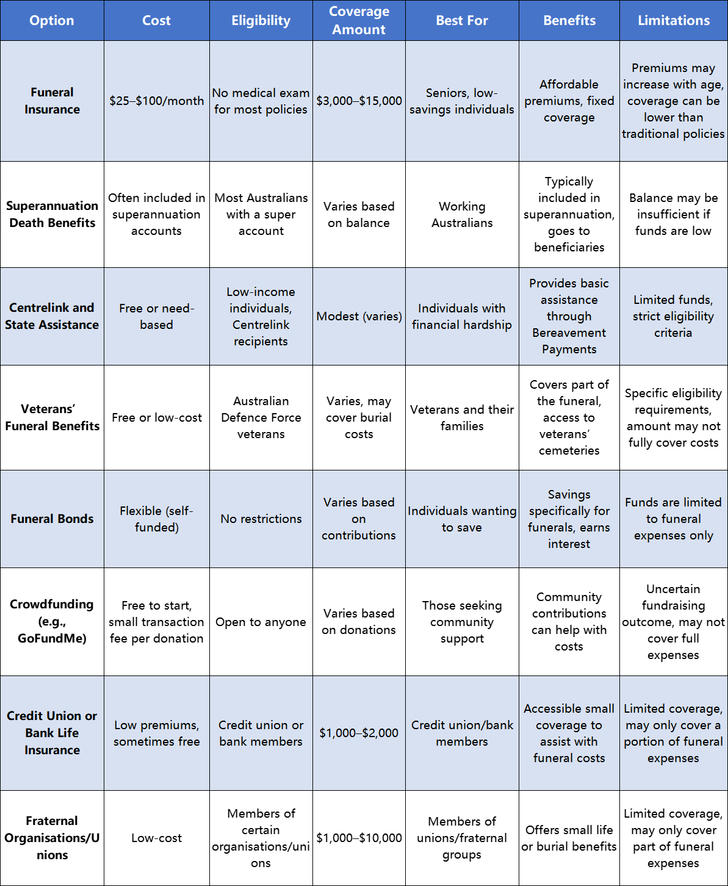

Comparison of Costs

Below, we outline key details for each option, including costs, coverage, benefits, and limitations:

Key Takeaways

• Funeral insurance generally costs $25–$100 per month, depending on age and health.

• Superannuation, Centrelink assistance, and veterans’ benefits are valuable options to help offset funeral expenses.

• Crowdfunding, credit union policies, and fraternal memberships can also help those on a budget cover funeral costs.

By exploring these options, you can find an affordable solution to cover final expenses and provide peace of mind to your family during a difficult time.