How to Find Free or Low-Cost Burial Insurance

Burial insurance, also known as final expense insurance, is a type of life insurance specifically designed to cover funeral and burial expenses. It's an affordable way to ease the financial burden on loved ones during a difficult time. But finding a policy that fits your budget doesn't have to be complicated. In this guide, we'll walk you through various options to help you find free or low-cost burial insurance.

Who Should Consider Burial Insurance

Burial insurance is an essential consideration for certain individuals who want to ensure their families aren't financially burdened by funeral expenses. Here are some groups who would benefit from this coverage:

1. Seniors

Seniors, particularly those over the age of 50, often seek burial insurance as a way to ensure funeral costs are covered without relying on their family. These policies offer predictable premiums that fit within a fixed income.

2. People with Limited or No Savings

With funeral costs averaging $7,000–$10,000, burial insurance can help those with little or no savings to afford these expenses. Even a small policy can prevent loved ones from facing financial hardship.

3. People Without Life Insurance or Insufficient Coverage

If you don't have traditional life insurance, or if your existing policy doesn't fully cover funeral costs, burial insurance can provide targeted coverage for your final expenses.

4. Individuals with Health Conditions

Many burial insurance policies don't require medical exams, making them accessible to individuals with pre-existing health conditions. These policies may have smaller payouts, but they are attainable even if you're in poor health.

5. People Seeking Low-Premium Options

If you're looking to cover only essential end-of-life expenses, burial insurance is a great alternative to larger life insurance policies. With lower death benefits and premiums, it's an affordable choice for tight budgets.

6. Individuals Wanting Peace of Mind

Having burial insurance gives individuals peace of mind knowing their families won't face the financial strain of funeral costs. This reassurance can provide emotional comfort during a difficult time.

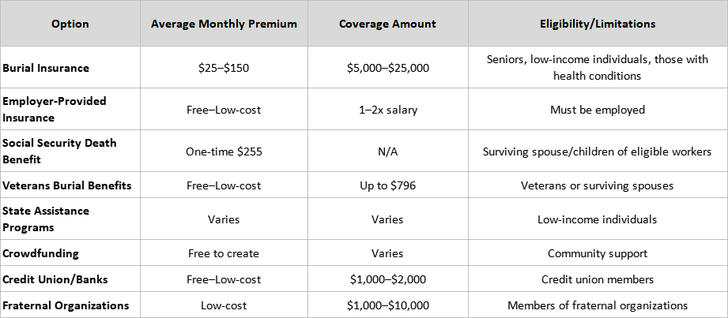

Free or Low-Cost Burial Insurance Options

There are several options available to help you cover burial costs without breaking the bank. Below, we outline the costs, benefits, and limitations of various burial insurance alternatives:

1. Burial Insurance (Final Expense Insurance)

• Average Monthly Premium: $25–$150

• Coverage Amount: $5,000–$25,000

• Who it's best for: Seniors or those with limited savings.

• Factors that affect cost: Your age, health status, and the amount of coverage you need.

• Cost Example: A 65-year-old may pay $50–$75 per month for $10,000 in coverage. A 75-year-old may pay $75–$100 or more.

• Benefits: A straightforward, targeted solution for covering funeral costs with minimal medical requirements.

• Limitations: Coverage may be lower than other life insurance policies, and premiums increase with age or health issues.

2. Employer-Provided Life Insurance

• Cost: Often free or low-cost as part of a benefits package.

• Coverage Amount: Usually 1–2 times your salary.

• Who it's best for: Employees with access to employer benefits.

• Benefits: Free or affordable coverage, which can be used to cover final expenses.

• Limitations: Coverage might not be sufficient to fully cover funeral costs, and it may not apply after employment ends.

3. Social Security Death Benefit

• Cost: $255 (one-time payment).

• Eligibility: Available to surviving spouses or minor children of deceased Social Security beneficiaries.

• Limitations: The amount is modest and won't cover the full cost of a funeral, which typically costs $7,000–$10,000.

• Benefits: A small amount to help offset funeral expenses.

4. Veterans Burial Benefits

• Cost: Free or low-cost.

• Eligibility: Veterans who have served in the U.S. military.

• Benefits: Burial in a national cemetery at no cost, plus burial allowances ranging from $300–$796 for qualifying veterans.

• Limitations: The amount may not fully cover all funeral expenses, but it provides significant assistance.

5. State and Local Assistance Programs

• Cost: Varies based on location and financial need.

• Eligibility: Low-income individuals or those with no family to assist.

• Benefits: Some states and local governments offer free or low-cost funeral services for eligible individuals.

• Limitations: Availability and coverage amounts vary by state, and eligibility may require proof of financial need.

6. Crowdfunding (GoFundMe, etc.)

• Cost: Free to create a campaign, but platforms like GoFundMe charge a small fee (2.9% + $0.30 per donation).

• Benefits: Can raise funds from friends, family, and the community to help cover funeral costs.

• Limitations: Fundraising success varies, and you may not raise enough to cover all expenses.

7. Credit Union or Bank Life Insurance

• Cost: Low premiums or even free for members.

• Coverage Amount: $1,000–$2,000.

• Benefits: A small, easy-to-access policy that can help cover part of the funeral costs.

• Limitations: Coverage may be insufficient to cover the full cost of a funeral.

8. Fraternal Organizations/Unions

• Cost: Typically low-cost, depending on membership.

• Coverage Amount: $1,000–$10,000.

• Benefits: Offers members small life insurance or burial benefits, which can offset funeral expenses.

• Limitations: Coverage is typically modest, so it may only cover part of the funeral costs.

Comparison of Costs

Key Takeaways

• Burial insurance typically costs $25–$150 per month, depending on your age and health.

• Consider employer life insurance, veterans' benefits, or social security death benefits as low-cost alternatives.

• Crowdfunding, credit union policies, and fraternal memberships are other options for those with limited funds.

• Combining multiple resources can help cover the full cost of funeral expenses.

By exploring these options, you can find an affordable solution to cover final expenses and provide peace of mind to your family during a difficult time.