4 Principles You Can Learn from Warren Buffett's Investing

Warren Buffett's wisdom is something investors can draw from, but the key lies in whether you can overcome human nature, and whether you can overcome yourself.

At Berkshire's annual reports and shareholder meetings, Buffett's views are often similar. Buffett particularly advocates the principle of consistency. What he said ten or even dozens of years ago, he still says and does today. Every year at the shareholder meeting, everyone hopes Buffett will impart some "magic skills" or talk about new things, often selectively ignoring the basic principles and concepts emphasized by Buffett.

However, investors who truly practice the principles and wisdom Buffett has elucidated over the decades may reap significant benefits in both their investments and lives.

1.Long-term Investment Perspective

The core of Buffett's investment philosophy is longtermism. Buffett spent a staggering 45 years researching and acquiring shares before fully controlling Geico, the fourth-largest insurance company in the United States. This was the most important acquisition in Buffett's career.

Buffett repeatedly emphasizes that if you don't plan to hold a company's stock for at least 10 years, don't even hold it for 10 minutes. Buffett doesn't engage in frequent buying and selling after purchasing stocks because any rebalancing during the process often signifies an unsuccessful investment. Buffett is unwilling to sell once he buys.

Buffett believes that the number of good companies is extremely limited. Since there are so few good companies in the world, decisions regarding investments should involve heavy positions and controlling stakes through a high proportion of equity.

Longtermism focuses on the long-term intrinsic value and "economic moat" of a company, while market prices and intrinsic values often deviate from each other. Therefore, investors and entrepreneurs must ignore the noise of market prices. That's why Buffett stays away from Wall Street and resides in a remote town like Omaha. To steadfastly adhere to longtermism, one must filter out the distractions of short-termism noise.

Buffett not only focuses on intrinsic value and "moat" but also chooses to buy at relatively low points, which eliminates the vast majority of companies from his investment list. According to Buffett's mentor, the "father of value investing," Benjamin Graham's standard, one should buy at a price lower than 2/3 of the net asset value. Such opportunities are too rare to come by unless there's a stock market crash, a natural disaster, or a man-made disaster. Thus, Buffett famously said: "Be fearful when others are greedy, and greedy when others are fearful."

In contrast, judging short-term macroeconomics, stock markets, and stock prices is even more difficult, akin to flipping a coin or rolling dice, with success depending solely on luck. In this regard, economists are no different from ordinary people.

2.The Secret of Compound Interest

The second principle of Buffett's investment philosophy is "compound interest." Buffett once referred to compound interest as the "eighth wonder of the world," and his partner, Munger, also said: "When you understand the value and difficulty of compound interest, you understand everything."

There's a story recorded by Islamic scholars in 1256 that epitomizes the concept of compound interest. While it sounds like a parable from the realm of self-help, Buffett truly believes in the logic of compound interest behind this story and has practiced it throughout his life.

Legend has it that a king in ancient India wanted to reward the prime minister who invented chess, so he asked the prime minister what he desired. The prime minister replied, "Your Majesty, I don't want your gold, silver, or jewels. All I ask is for you to place some grains of wheat on my chessboard as a reward. Please place one grain of wheat on the first square of the chessboard, two grains on the second square, four grains on the third square, and so on, doubling the number of grains for each subsequent square until all 64 squares are filled."

So, how much wheat would it take to fill the entire chessboard? Approximately over 55 billion tons! However, in 2021, wheat production in the United States was only about 187 million tons.

Many people dismiss this story, likening it to self-help clichés or mere brain teasers. But when Buffett heard this story, he believed he had found the ultimate wisdom of the business world. He is a true investor who has amassed astronomical wealth by harnessing the power of compound interest.

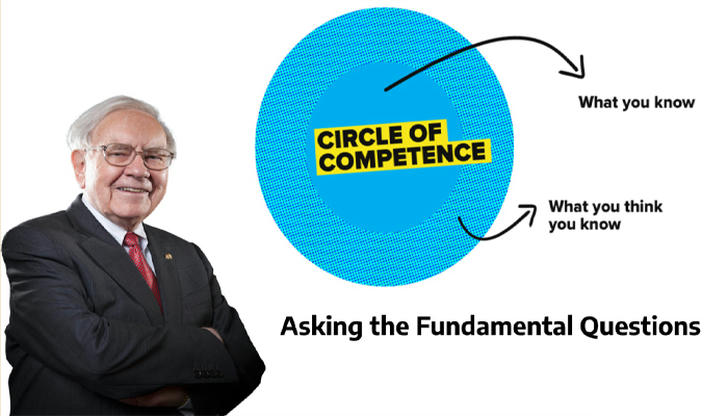

3.Focus on Your Circle of Competence

Adhering to longtermism and obtaining the miracle of compounding not only involves assessing a company's present value but also envisioning its intrinsic value and "moat" 10 or 20 years down the line. Therefore, those who conduct in-depth research into industries and companies are the ones who can reap the rich rewards of longtermism.

The third principle of Buffett's investment philosophy is the Circle of Competence. It states that money within your circle of competence should be earned. Money beyond that circle is not your concern. It's only regrettable if you fail to earn money within your circle of competence. If you happen to earn money outside your circle of competence, it's likely due to luck, and that money may sooner or later be lost.

Out of reverence for his circle of competence, Buffett rarely ventures into technology companies, or more accurately, consumer internet companies. It's not that technology companies are bad, but Buffett's circle of competence has its boundaries, and he doesn't have the skills to manage such investments

Of course, one's circle of competence can expand, which is why Buffett often mentions that "the greatest investment you can make is in yourself." You can push yourself to learn more and expand your circle of competence.

4.Embrace the Fortunes of the Nation

The fourth principle of Buffett's investment philosophy is particularly important and distinctive: "Embrace the Fortunes of the Nation."

In his 2019 letter to shareholders, Buffett reviewed his 77-year investment history, summarizing various pessimistic events in the United States since 1942, such as wars, inflation, and financial crises. He and Charlie Munger then stated that Berkshire's success has largely been riding on the tailwinds of the U.S. economy, and in the next 77 years, their major gains will likely still come from "the American tailwind."

Buffett knows those downturns will come, but based on the American Tailwind theory, he is equally confident that the market will eventually recover.

As an investor, you may currently feel lost and confused, but in the long run, present difficulties will become history. From an individual perspective, these challenges often seem like mountains, but from a national perspective, they're mere specks of dust. The wheels of history will surely continue to advance, and the national economy will continue to progress. After a slump, you can be confident that the country will recover and the economy will boom again.

Conclusion

A good start is half the battle won. Buffett's stringent investment selection criteria are the primary guarantee of his successful investments. The four principles outlined above may seem difficult to achieve, but through rational thinking, long-term practice, and relentless effort, they are still achievable.