6 Best Budgeting Apps for Personal Finance

Managing your finances can often feel overwhelming, but with the right tools, it becomes much more manageable.

One of the most effective ways to keep track of your spending and saving is by using budgeting apps. These apps help you stay organized, make informed decisions, and reach your financial goals.

In this article, we'll explore some of the best budgeting apps available, their unique features, and how they can make your financial journey smoother.

Why Use a Budgeting App?

Before diving into the apps, let's discuss why you should consider using one. A budgeting app allows you to:

• Track Expenses: You can easily log and categorize your daily expenses, so you know where your money goes each month.

• Set Goals: Whether you want to save for a vacation or pay off debt, these apps let you set specific financial goals and monitor your progress.

• Create Budgets: You can establish monthly budgets based on your income and expenses, helping you stick to your financial plan.

• Gain Insights: Many apps provide reports and insights, allowing you to identify spending patterns and areas where you can cut back.

Now that you know the benefits, let's look at some of the top budgeting apps available today.

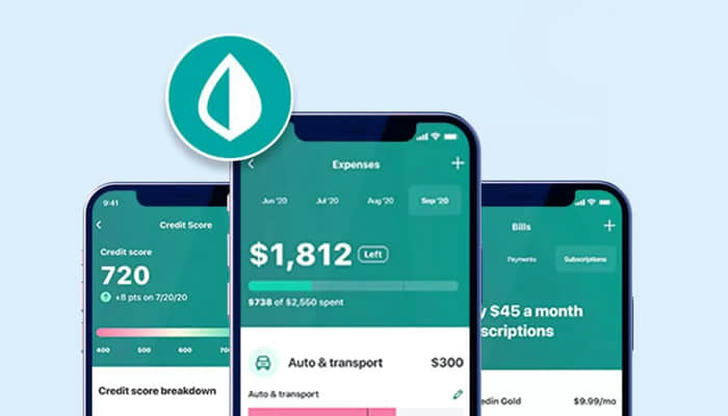

1.Mint

Mint is one of the most popular budgeting apps out there, and for good reason. It's free and user-friendly, making it ideal for anyone just starting with budgeting.

Key Features:

• Account Linking: Mint allows you to link your bank accounts, credit cards, and investments. This gives you a complete overview of your finances in one place.

• Automatic Categorization: When you make a purchase, Mint automatically categorizes it (like groceries, dining, or entertainment), so you can see where your money is going.

• Budget Creation: You can set budgets for different categories and receive alerts if you're nearing your limit.

Why You'll Love It: Mint's intuitive interface and real-time updates make it easy to stay on top of your finances. Plus, its free service means you can get started without any commitment.

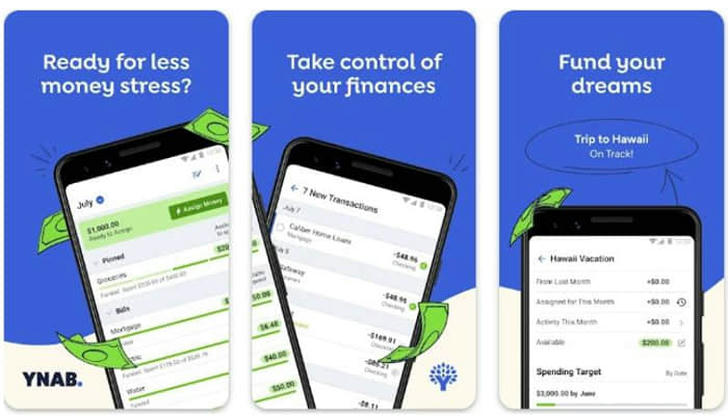

2. YNAB (You Need a Budget)

YNAB takes a unique approach to budgeting by focusing on proactive money management. It's a paid app, but many users find the investment worth it.

Key Features:

• Zero-Based Budgeting: YNAB encourages you to allocate every dollar to a specific category, ensuring that you know where each dollar is going.

• Goal Setting: You can set financial goals and track your progress, whether it's saving for a car or paying off credit card debt.

• Education: YNAB offers resources and workshops to help users improve their budgeting skills.

Why You'll Love It: If you want to take control of your spending and learn more about personal finance, YNAB's educational resources are invaluable. The app's focus on proactive budgeting can lead to significant improvements in your financial health.

3. PocketGuard

If you often find yourself asking, "How much can I spend today?" PocketGuard is the perfect solution. This app simplifies budgeting by showing you how much disposable income you have after accounting for bills, goals, and necessities.

Key Features:

• In My Pocket: This feature shows you how much money you have left to spend after covering your fixed expenses and savings goals.

• Expense Tracking: You can categorize your expenses and track them easily, helping you stay within your budget.

• Bill Reminders: PocketGuard sends reminders for upcoming bills, so you never miss a payment.

Why You'll Love It: PocketGuard's simplicity is its greatest strength. If you prefer a straightforward approach to budgeting without the complexity of traditional methods, this app is for you.

4. EveryDollar

EveryDollar is a budgeting app created by financial expert Dave Ramsey. It's designed for zero-based budgeting, making it an excellent choice for those who want to be intentional with their money.

Key Features:

• Drag-and-Drop Budgeting: You can easily drag and drop expenses into different categories, allowing for quick adjustments.

• Goal Tracking: Set savings goals and track your progress within the app.

• Income Tracking: You can input your income and see how it fits into your budget.

Why You'll Love It: If you're a fan of Dave Ramsey's financial philosophy, you'll appreciate the structured approach EveryDollar offers. Its user-friendly design makes budgeting feel less daunting.

5. GoodBudget

GoodBudget is a unique app that uses the envelope budgeting method, where you allocate money to different spending categories (or envelopes). It's especially useful for those who want to control their spending more tightly.

Key Features:

• Envelope Budgeting: You can create digital envelopes for different spending categories, helping you visualize your budget.

• Sync Across Devices: GoodBudget allows multiple devices to sync, so you and your partner can stay on the same page.

• Expense Tracking: Keep track of your expenses and see how much money is left in each envelope.

Why You'll Love It: GoodBudget's envelope method can help you stick to your budget by making you more aware of your spending limits. Plus, its cross-device sync feature is perfect for couples managing finances together.

6. Personal Capital

While primarily an investment tracking app, Personal Capital also offers budgeting features that can help you manage your overall financial picture.

Key Features:

• Investment Tracking: See how your investments are performing and receive advice on how to optimize your portfolio.

• Cash Flow Tracking: Monitor your income and expenses in real time, giving you a complete view of your finances.

• Retirement Planner: Personal Capital provides tools to help you plan for retirement, making it a great choice for those thinking long-term.

Why You'll Love It:

If you're looking to manage both your budget and investments in one place, Personal Capital is a fantastic option. Its retirement planning tools are particularly helpful for those focused on long-term financial health.

Choosing the Right App for You

With so many budgeting apps available, it's essential to choose one that fits your lifestyle and financial goals. Consider factors like:

Ease of Use: If you're not tech-savvy, opt for a user-friendly app. Features: Think about what you need—tracking expenses, investment management, or goal setting. Budget: Some apps are free, while others require a subscription. Decide what you're willing to invest.

Conclusion

Budgeting doesn't have to be a chore. With the right app, you can simplify the process, gain insights into your spending, and work towards your financial goals. Whether you choose Mint for its simplicity, YNAB for its proactive approach, or another app that suits your needs, remember that the key to successful budgeting is consistency and commitment. So download an app, take control of your finances, and watch your financial health improve!